Restaurants: A Year in Review

Amit Raizada

December 27, 2020

In my more than twenty years as a venture capitalist and entrepreneur, I’ve always felt a strong affinity for the restaurant industry. I’m a foodie at heart, and I love being able to back the ventures that help share the wonders of food with the world.

Restaurants have always comprised a significant portion of my investment portfolio—and, as such, I write a lot about the industry. Back in February, I wrote an article about developing successful restaurants in which I stated that restaurants should work to cultivate a unique atmosphere and embody a certain energy.

Wow—to think how much has changed in the last ten months! Little did I know that no less than a month after writing that piece, restaurants around the country would be asked to close their doors upon the coronavirus’ arrival in the United States. Little did I know that most of these restaurants would go months without accommodating a single dine-in customer, that proprietors would need to devise a wholesale transition to patio dining just to stay afloat, and that millions of hospitality workers would soon lose their jobs.

The restaurant industry has been turned upside down in the time since I wrote that piece.

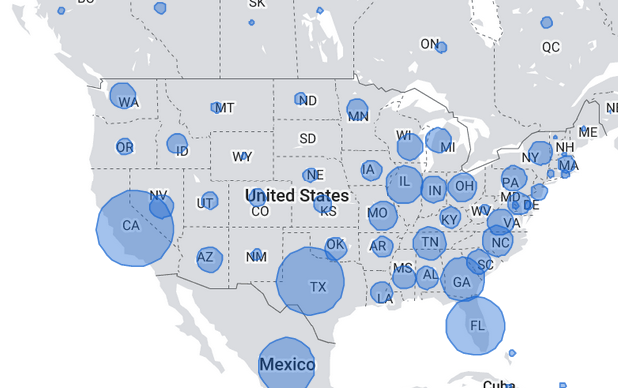

Now, restauranteurs and investors are constrained by a national patchwork of regulations and restrictions. In some states, restaurants are operating almost as normal. In others, like California—one of the nation’s culinary capitals—restaurateurs have been on a rollercoaster ride.

After only being permitted to offer take-out dining in the spring, most restaurants were able to accommodate outdoor dining during the summer months. Proprietors spent large sums of money on tarps, decks, and furniture to build attractive outdoor patios for diners. In late November, amid a nationwide surge in cases, outdoor dining was shuttered across the Golden State, leaving restaurants to pivot back to take-out only models.

As this troublesome year winds down, I wanted to share a few thoughts I’ve had about the restaurant industry, where it’s been, where it’s going, and how it can make the most of this inauspicious situation.

FOCUS WHAT YOU CAN DO

The COVID-19 pandemic has significantly constrained restaurants’ ability to operate in a normal capacity. While many of these restrictions are necessary to slow the spread of the virus and ultimately save lives, it benefits restaurateurs to focus less on what they cannot do and more on ways to maximize what they can still do.

In states like California, the answer may be that restaurants are only permitted to fulfill take-out or to-go orders. In other markets, restaurants may be able to accommodate the public on outdoor patios. Whatever the restrictions in your municipality may be, discern which functions are still permissible and leverage those to the best of your ability.

CREATE NOVELTY

In earlier iterations of my musings on restaurants, I wrote that proprietors should focus on cultivating within their establishment a unique and trendy atmosphere that transforms dining at your restaurant into a sharable, unique experience.

While new restrictions have recharted the ways in which this is possible, I encourage restaurateurs to figure out how to make eating at their establishments feel like a novelty—and something worth sharing with family and friends—during the pandemic.

This could involve a pivot in service or recalibrating your cuisine to better meet the needs of a pandemic era-crowd. Developing ambiance during a pandemic is far easier said than done, but must nonetheless be a priority for restaurants adapting to this era of uncertainty.

THINGS WILL GET BETTER

I know that the last thing any struggling restauranteur wants to hear during these trying times is a platitude, but with the Pfizer and Moderna vaccines already being administered to the public, the restaurant industry looks ripe for a resurgence at some point in 2021.

When the clock struck midnight last January 1, no one could have foreseen the struggle and discord the proceeding 364 days would have in store for our society, the boom to Zoom & at home fitness companies like Peloton, and our country. But we’re here now, vaccines are on their way—keep your heads up.