Chartering a Luxury Yacht in SoCal this Winter

Amit Raizada

December 1, 2020

Believe it or not, the period spanning from autumn through early winter is one of the best times to explore the California coast and the many treasures the majestic Pacific Ocean has to offer. With water temperatures still relatively warm and high-pressure systems ensuring plenty of sunshine, spending a day on the Pacific is seemingly inseparable from the Southern California holiday season experience.

This year, the water will carry special resonance for many. After nearly eight months of various degrees of quarantine, the ocean offers the perfect opportunity to get outside the house and indulge in the great outdoors, all while still accommodating social distancing requirements. After all we have experienced over the last year, there’s nothing more liberating than sailing full speed across the water with the wind in your hair and the sea spray lapping across the deck.

One of the best ways to fully experience the California coast is to charter a yacht. These outings offer myriad ways to build lasting family memories all while closely complying with COVID-19 social distancing guidelines.

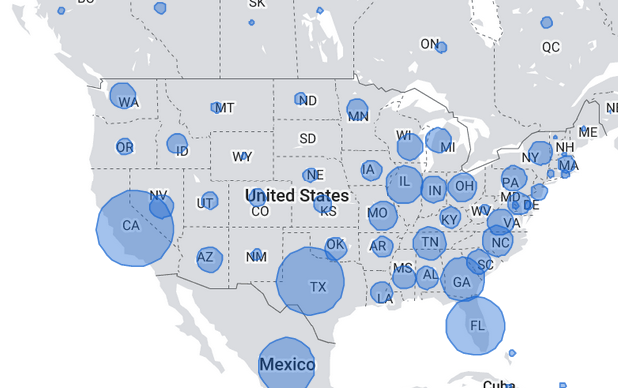

Amit Raizada, the proprietor of Veloce Yacht, a more than 100-foot vessel based in Newport Harbor, said that many Americans—both Californians and tourists—have been especially eager to hit the water this year.

“For much of this past year, we’ve all been cooped up,” he said. “The ocean is, in so many different ways, therapeutic. It offers individuals the opportunity to, both literally and figuratively, chart their own course—a stark contrast from everything we have experienced this year. With the beautiful weather and the holidays coming up, chartering a yacht is a great way to have some safe fun amid this challenging year.”

Raizada said that families can charter Veloce Yacht to captain their own personal adventures around the California coast. Whether racing from Orange County up to Malibu or enjoying the vessel’s state-of-the-art sound system off the OC coast, Veloce Yacht offers endless possibilities for adventure, he said.

“A popular destination has always been Catalina,” Raizada said. “Located less than an hour off the Los Angeles coast, Catalina is a Mediterranean paradise replete with dramatic contours, hidden lagoons, and untouched nature. Circumnavigating the island is a holiday adventure that families won’t soon forget.”

Raizada said, however, that charting a yacht offers innumerable possibilities, including those for individuals and families who prefer leisure to action. One of the industry’s most popular services is harbor tours, he said. Whether in Santa Barbara, Ventura, or Orange County, harbor tours allow groups to host dinners and parties while gently navigating the harbors, usually at sunset. This service offers unforgettable views and an unbeatable atmosphere. In the age of COVID-19, harbor tours can even accommodate social distancing.

“During this difficult time, safety is more important than anything,” Raizada said. “Harbor tours limited to individual households offer an outdoor opportunity to have a holiday dinner with an incredible atmosphere. Christmas dinner on the deck of a yacht sailing smoothly through a harbor is such a California way to spend the holiday.”